BlockchainCryptocurrency

Bitcoin Halving: the ongoing chaos and consequent challenges

Jens Beckert gave a berserk, but a rather interesting economic concept, known as “Imagined Futures.[1]” The theory, in its crux, basically elaborates upon traditional economic theories, where decisions and conceptions are based on history, and how such decisions and conceptions aren’t exactly fair. Instead, his theory states that it’s a fact that people also tend to make decisions based on what they believe might come true in the future. And though subjective, these conceptions need to be taken into account too, because regardless of their manifestation, they coordinate a class of people to work towards a more sustainable future.

Many might critique his theory, and they might be justified, but the emergence of bitcoin, as a form of digital currency seems to be the most contemporary example of his theory coming alive. Right from its origin as a mere white paper source code in 2008, to it being identified as the catalyst that initiated the cryptocurrency movement, the bitcoin market has reached new heights. Spurred by a growing user base, price volatility, and the rapidly evolving network of bitcoin-related investments and companies, it seems like this digital form of currency is here to stay.

However, it’s not all rainbows and sunshine for bitcoin. Today, the bitcoin market doesn’t seem to be as profitable or promising as it was, say 5 years ago. And the upcoming “halving” phenomenon, certainly wouldn’t act as much of an aid to a form of currency, which has already seemed less viable to the investors, as the time has passed by. The upcoming “halving” rule is said to shake the crypto markets this year. It’s nothing new, or something that anyone is in control of, and is rather a rule introduced by Satoshi Nakamoto, bitcoin’s pseudonymous creator, who imbibed it into bitcoins’ underlying code, almost a decade ago. What this would mean, is that after May 2020, the process would slash the number of new coins awarded to bitcoin miners by half, thus leading to lack of incentive and motivation for those, who ensure the flow of new Blockchains, and consequently, new bitcoins, by solving complex math puzzles, and deciphering accompanying source codes. This comes with its own sets of merits and setbacks.

The first point of consideration while looking into the impact of halving has to be the mining stability of the system. The mining stability of the system is synonymous to the “Hashrate” of the system. Hashrate is the term used to describe the computational ability of a network. Higher the hash rate, more the speed and security of the network. Conversely, lower the hash rate, lesser the speed and security of the network.[2]

Bitcoin miners are heavily dependent on block rewards, as the primary source of their income through Bitcoins. So, what would be the impact of halving on them and how would they deal with it? What effect would it have on the hash rate? Will it simply lead to miners leaving the network to cut their losses or would they stay to reap the benefits of the seeds that had been sown by them?

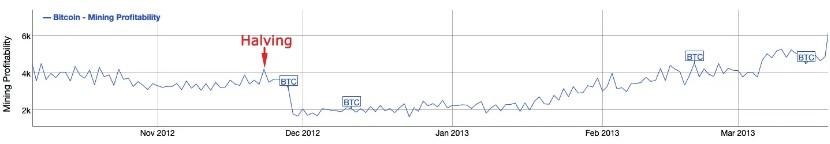

Let’s have a look. The various independent players in the market are preparing for a sharp price gain. The accompanying volatility that has cursed the previous halvings, might justify why the decentralized digital currency hasn’t lived up to the hype it was initially subject to and has confounded regulation and acceptance by mainstream finance: Its fate remains tied to arcane technological factors, and of course, temperatures. Coupled with the unpredictability factor that would accompany such a halving, bitcoin seems to tick all the boxes, when it comes to basic economic theories, and on the subject of what not to invest into. But that has been the beauty of bitcoin: despite its unpredictability and volatility, somehow, the said cryptocurrency has continued to grow. For instance, after the 2012 and 2016 halvings, the bitcoin rose by around eighty and four times respectively. This time around too, experts hope for increased returns from this halving. Such volatility in bitcoin markets tends to benefit quantitative hedge funds and high- frequency traders that seek to make money from swinging crypto prices. But for miners that hold large inventories of bitcoin, volatility can also act as a hindrance.[3] For them, the stability of price gives greater predictability for investment in new gear, because as long as bitcoin continues to defy basic economic theories, all seems well and good for its investors. But the question remains, for how long can such volatility ensure gains? There has to be a breaking point, and at a time when people are growing more accepting of bitcoins and the crypto market as a whole, now definitely wouldn’t be the ideal time for such a breakdown to occur.[4] Couple that with the ongoing pandemic, and the accompanying economic slowdown, the question arises, whether it is a good time to invest in bitcoins?

Mining Profitability after the halving of 2012 Source: BitInfo Charts

Mining Profitability after the halving of 2016 Source: BitInfo Charts

How would the Ongoing Pandemic Affect Bitcoin Halving?

The experts stand divided on this and there are valid reasons for the same. Bitcoin halving requires new mining equipment every time, i.e. more powerful and advanced machines and large quantities of electricity (accompanied with optimal temperatures, the lower, the better). Now, almost 70-75% of the mining database is controlled by China and North Korea, which are two of the worst affected countries during this pandemic. Therefore, because of the lockdown and economic slowdown, the setting up of new mining farms seems like a far-fetched dream, since the manufacturing of new machinery is at a standstill and consequentially, the hash power is down. However, another school of thought believes that this might be the most optimal time to invest in Bitcoin. Mr. Danny Masters, the executive Chairman of CoinShares says, “Bitcoin is arguably the only financial asset that can operate remotely — nobody needs to go to work to make bitcoin work. Nobody needs to fill an ATM machine. While things look bleak for everything else, I can’t think of a better asset to buy than bitcoin right now.”[5] Computers and Servers are never down, regardless of anything, be it a pandemic or any other emergency situation. While all the other economic assets are inflationary in nature, Bitcoin does have an upper cap of 210,000 blocks. What this means is that its value is solely dependent on mining and not the other economic assets or injection of more and more coins. Therefore, technically, Bitcoin isn’t as vulnerable to economic slowdown as the other economic assets are. Hence, many experts are deeming it as the most ideal time for investment, looking at the scope of growth of Bitcoin, and the economic slowdown in the other sectors. However, the risk remains upon the buyer or the miner, since Bitcoin volatility is stranger to none, and nothing can be said unless and until such halving actually takes place. Hence, it is advised to take risks, but also remain cautious at the same time.

[1] BECKERT, J. (2016). Imagined Futures: Fictional Expectations and Capitalist Dynamics. Cambridge, Massachusetts; London, England: Harvard University Press.

[2] Mitra. R, Bitcoin Halving: The Most Important Date In Bitcoin. Retrieved from https://blockgeeks.com/guides/bitcoin-halving/

[3] Rice, D. (2013). The Past and Future of Bitcoins in Worldwide Commerce. Business Law Today, 1-4.

[4] Wilson, T. (2019). Heard of bitcoin’s ‘halving’? It’s set to shake crypto markets in 2020. Retrieved from

https://www.reuters.com/article/us-crypto-currencieshalving/heard-of-bitcoins-halving-its-set-to-shake-crypto- markets-in-2020idUSKBN1YN19A.

[5] Willms. J, Coronavirus, the Halving and a Price Drop: Bitcoin Mining Marches On Bitcoin Magazine, Retrieved from https://www.nasdaq.com/articles/coronavirus-the-halving-and-a-price-drop%3A-bitcoin-mining-marches- on-2020-03-2