Future of Work

3D Printing and Copyrightability

Introduction

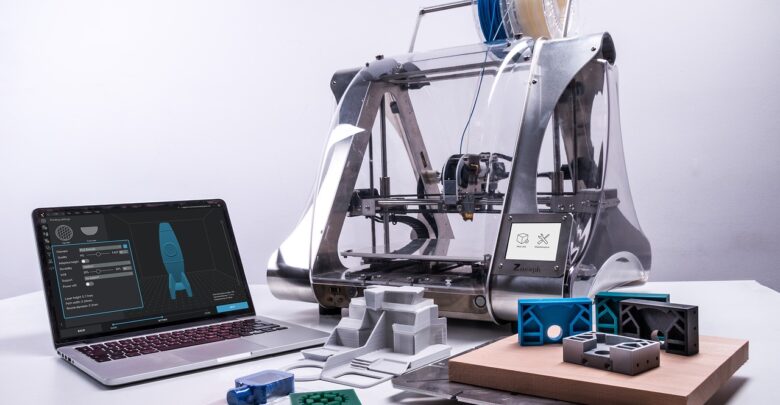

3D Printing has advanced from a simple theoretical and need-based technological instrument to a substantial implement of modern manufacturing in the past three decades. This unique technology permits innovation concentrated organizations and companies to lessen their overheads when creating, planning, or testing new goods or improving existing ones. Without paying for test-models, producers can quickly and inexpensively embrace numerous cycles of complex products through in-house 3D printers. The printing procedure begins with a digital code in which the item to be printed is carefully organized utilizing either 3D print programming or a 3D scanner.[1] The advanced record comprises a plan or model/outline, which can likewise be composed as a code on a Computer-Aided Design (“CAD”) document. Moreover, a CAD can also be made with a 3D scanner, which can check any object and make a blueprint. The code is then sent out to a 3D printer, which changes the digitized input or model into a physical item through a procedure wherein raw materials are layered one on top of another until a physical product is formed.[2] This procedure is often known as additive manufacturing and has virtually changed how the world perceives the production sphere. The technology is no doubt transformative and makes lives much easier; however, it at the same time infringes upon the global understanding of intellectual property rights. The use of this technology allows a massive scope for misuse of the intellectual property and ownership rights of others. Unapproved replication of items with individual 3D printers essentially implies significantly lesser monetary considerations for the proprietors and innovators of the said item.[3] Accordingly, this paper aims to analyze the various layers between 3D printing and Intellectual property rights, examine the legislative tenets in this particular field, and present a few ideas for reform.

3D Printing and IPR: General Precepts and International Regulations

The new and multi-dimensional assembling procedure of 3D printing influences practically all regions of the Intellectual Property (“IP”) law. The CAD record, the copied blueprint, or a simple new creation can quickly raise debates around IP law issues.[4] Copyright law, programming law, structure law, and patent laws[5] are probably the most discussed zones, with regards to 3D printing. The principal inquiry to be posed is whether IP laws in their present structure can grasp such a sweeping innovation and ensure against conceivable encroachment, or do they require a new form of sui generis rights? Nevertheless, the standard special regulations and restrictions that exist in the global (understandings and agreements) and transnational (Directives, Regulations, the Continental European lawful frameworks) model of IP laws likewise normally apply to 3D printing.[6] For instance, concerning patent law, Article 30 of the Agreement on Trade-Related Aspects of Intellectual Property (“TRIPS”) expresses that signatories could give exceptions to the general understanding of control over a patent.[7] Accordingly, some directive laws of the state’s party to the agreement consider the rights of a patent holder as inclusive of any private acts for 3D printing and don’t regard private printing as an encroachment of IP rights.[8] In the territory of copyright laws, the rights conceded to creators can be restricted by the purported three-advance test.[9] Article 13 of the TRIPS Agreement expresses that “individuals will restrict confinements or exemptions from IPR regulations to certain extraordinary cases which don’t strife with an ordinary abuse of the work and don’t irrationally override the rights of the patent holder.”[10] Accordingly, some TRIPS nations have allowed a system of privilege for private duplication, thereby approving an individual to repeat a patented work for private use. An analysis of the European Continental law would shed some light on this particular field of debate.

Continental European IP framework (otherwise called Civil Law) depends on enactments as opposed to legal points of reference or court mandates.[11] In the IP regime, this legal construct restricts ambiguities regarding the sectional application of rules.[12] Consequently, a very strict understanding of this regulation may lead to the misreading of a particular issue and qualify a certain 3D enactment as infringement, which a more inclusive application of the said law would not do. Accordingly, the current IP regime that 3D printing extensively affects, includes copyright, patent, and, above all, design rights.

Under the copyright law, a 3D CAD document (however not a 3D copy) can fall under copyright provisions, as it covers specialized drawings, graphs, and models.[13] Also, 3D CAD can be considered as subsidiary works from a unique work with the exclusion of explicit materials and shapes of unadulterated specialized capacity.[14] Software protection, which additionally falls under the copyright system is likewise conceivable. Regardless, since 3D CAD isn’t executed by a PC as a product and is read to essentially design the item, this provision will not remain applicable.[15] Furthermore, patent rights may emerge, if a protected innovation is duplicated. The development and innovation contained in the item would in this way be ensured. A CAD record containing a plan for the protected innovation will be protected under the patent system.[16] The replication of the design of the item, in any case, will be barred. Additionally, design rights ensure that the outside shape and highlights of the entire or parts of the item being referred to are protected.[17] The appearance and individual design of the product too will be secured under manufacturing rights.[18] Along these lines, one can expect that any CAD document containing the structural outline of an item will naturally be encroaching and infringing IPR regulations. In any case, the crude materials, inner parts non-noticeable during open use, or structural plans that are ordinary in the pertinent specialized fields are excluded from this particular tenet of IPR regulations.[19] Additionally, items and products designed for ancillary associations with another item (ex: additional or spare parts) and highlights that only perform technical functions are not protected under general international regulations.[20]

Indian Riders for 3D Printing

As viable as it is for buyers to utilize a specific innovation, it is similarly essential for the programmers and developers of new goods to deliver, secure, and procure monetary considerations from it. Four sorts of IP marks will bear the brunt of 3D printing in India that are copyrights, plans, patents, and trademarks.[21] While copyright laws protect novel ideas, design laws secure product appearances, patent laws secure innovations, and trademark clauses protect the market share of a good. Nevertheless, for quite some time now the Indian IP law sphere has seen itself involved in deliberations that question the capacity of its current legislative enactments to cover new technological advancements; foremost of all being 3D printing.

Understandably, most physical items — the sort of articles 3D printers produce are utilitarian in nature.[22] A large portion of these items, nonetheless, are neither new nor unique and are for that very reason not protected by Indian patent (or any other IPR tenet) laws.[23] Therefore, only a few articles or certain portions of an object printed out of 3D machines will be protected by IPR laws.

To cover the copyright aspects of 3D printing in India, Section 13(1) of the Copyright Act, 1957[24] accommodates products in which copyright remains alive and arranges works into three expansive classes—(I) unique literature and dramatic productions; (ii) cinematographic efforts; and (iii) sound compositions.[25] For the 3D printing to qualify as literary work, it would have to be of the form of an artwork, a figure, a drawing (counting an outline, guide, diagram, or plan), an etching, or a photo, regardless of whether any such work has imaginative quality; (b) a work of design; and (c) some other work of masterful craftsmanship.[26] Furthermore, the Copyrights act characterizes a “computer” as any electronic or comparative gadget having data handling abilities.[27] Under the act, a PC program essentially communicates a set of directions in words, codes, plans, or in some other structure, inclusive of a machine comprehensible medium, fit for making codes that give specific instructions to computer-based programs.[28]

Furthermore, a convoluted overlap exists between different IP tenets, even more so between the Trademarks Act and the Design act. The Designs Act, 2000[29] characterizes any, counterfeit, or mostly fake and halfway regular items in violation of IPR regulations. Moreover, it characterizes a “design” as according to the highlights of shape, the arrangement, adornment, or synthesis of lines formed in an article regardless of two-dimensional or three-dimensional products.[30] Hence, 3D objects printed under these regulations will negate the Indian Intellectual Property Rights tenets.

Similarly, copyright laws through Section 15[31] solely excuse copyright in any structure that is enlisted or equipped for enrollment under the Designs Act, 2000. Additionally, if there is a copyright in any design capable of such registration under the Designs Act, the copyright to the article to which the design is applied shall cease to be in effect as soon as it is reproduced more than 50 times by an industrial process, by the owner of the copyright or by a separate license holder.[32] Under the definition of “design”, Section 15(2) loses all potency, for there can be no subject-matter that is both copyrightable and design registrable, that is, no artistic work would ever qualify for protection as a design.[33]

These particular aspects of the Indian riders for 3D printing create inadequacies amongst themselves, it’s advisable to further the Indian legislative in aspects of clarity to remove as many inconsistencies as possible. The current group of IP laws in India aren’t outdated or harsh; however, the laws can be given a wider ambit so as to incorporate the present day, problematic advances like 3D printing. Moreover, minor changes in the current set-up will help create lucidity with reference to the status and treatment of up-and-coming advancements under Indian enactments. Social orders everywhere and laws are continually set-in opposition to new advancements; the test is to keep up a harmony between privileges of different people across various fields. 3D printing is simply one more case of what might be on the horizon and there is no better solution, other than accommodating it as legitimately as possible.

Conclusion

Intellectual Property laws currently seem exhaustive enough to cover the 3D printing regime; however, the number of inadequacies discussed above express the intermittent failings of the regulations. No legal precept can be understood as perfect, neither can it cover all aspects of a social issue; nevertheless, a regime as significant as Intellectual Property should have provisions that don’t incorporate overlapping tenets or practice inconsistent segregations. The Indian economic and technological sphere has seen considerable growth over the last decade and is expected to grow even more in the coming years. The pandemic may have been a roadblock; regardless, the growth of the industry will resume its earlier pace in no time. Consequently, it is the duty of the legislative bodies to formulate regulations that keep up with the times. A systematic analysis of the failings of the current regulations is what will propel the required emendations. In an effort to conclude the multiple ideas in this paper, the major focus of the judicial as well as legislative implements of the country should be towards making as an equitable provision as possible for the 3-dimensional section of the Indian intellectual property rights laws.

Endnotes

[1] N. Shahrubdin, T.C. Lee & R. Ramlan, An Overview on 3D Printing Technology: Technological, Materials, and Applications, 35 Procedia Manufacturing, 1286, 1287-1290 (2019).

[2] Lexology, Legal Aspects of 3D Printing Intellectual Property Domains, https://www.lexology.com/library/detail.aspx?g=c4cd093d-2b24-4c17-8e80-2fcdbabcc9b0 (last visited July 5, 2020).

[3] THE SCC ONLINE BLOG, IPR and 3D Printing- The Legal Treatment to Disruptive Technology, https://www.scconline.com/blog/post/2019/01/24/ipr-3d-printing-the-legal-treatment-to-disruptive-technology/ (last visited on July 5, 2020).

[4] Gonec Gurkaynak, İlay Yılmaz, Burak Yeşilaltay, and Berk Bengi, Intellectual Property Law and Practice in the Blockchain Realm, 34 (4) Computer Law & Security Review, 847, 847-849 (2018).

[5] Id[6] World Intellectual Property, 3D Printing and IP law, https://www.wipo.int/wipo_magazine/en/2017/01/article_0006.html#:~:text=The%20standard%20exceptions%20and%20limitations,naturally%20apply%20to%203D%20printing.&text=In%20other%20words%2C%20when%20an,an%20infringement%20of%20IP%20rights (last visited on July 5, 2020).

[7] Agreement on Trade-Related Aspects of Intellectual Property Rights, Apr. 15, 1994, Marrakesh Agreement Establishing the World Trade Organization, Annex 1C, 1869 U.N.T.S. 299, 33 I.L.M. 1197(1994), Art. 30 [hereinafter TRIPS].

[8] Corporate Law Advisory, 3D Printing: The Next Disruptive Technology to Test Existing Law, https://www.lexisnexis.com/communities/corporatecounselnewsletter/b/newsletter/archive/2017/03/07/3d-printing-the-next-disruptive-technology-to-test-existing-law.aspx (last visited on July 5, 2020).

[9] Id [10] Art.13, TRIPS. [11] Law Berkeley, The Common Law and Civil Law Traditions, https://www.law.berkeley.edu/wp-content/uploads/2017/11/CommonLawCivilLawTraditions.pdf (last visited on July 5, 2020). [12] Id [13] Lexology, supra note 2. [14] Id [15] Id [16] Id[17] Yourstory, What is Industrial Design Protection and how can one protect their designs ? ,https://yourstory.com/2015/07/what-is-industrial-design-protectiontheir-designs (last visited on July 5, 2020).

[18] Id[19] Wired, Law and 3D Printing: Designers Can Work Around Lack of Cover, https://www.wired.com/insights/2013/09/ip-law-and-3d-printing-designers-can-work-around-lack-of-cover/ (last visited on July 5, 2020).

[20] Id [21] The SCC Online Blog, supra note 3.[22] Google Books, 3D Printing and Beyond: Intellectual Property and Regulation,https://books.google.co.in/books?id=ZROKDwAAQBAJ&pg=PA66&lpg=PA66&dq=3D+printing+produces+utilitarian+objects&source=bl&ots=hKVUyQZ8ZF&sig=ACfU3U2KjSIumKFmY2zcyPq8eSfvv2aXCw&hl=en&sa=X&ved=2ahUKEwis9JOks7PqAhWjW3wKHbN1C5cQ6AEwCnoECAsQAQ#v=onepage&q=3D%20printing%20produces%20utilitarian%20objects&f=false (last visited on July 5, 2020).

[23] Id. [24] The Copyright Act, No. 14 of 1957, India Code (1993), §13(1). [25] Lexology, Copyright in India, https://www.lexology.com/library/detail.aspx?g=ef8e848b-753c-4eb3-a9e6-198564494f23 (last visited on July 5, 2020). [26] Lexology, supra Note 21. [27] Mondaq, Trademarks Law in India- Everything You Must Know, https://www.mondaq.com/india/Intellectual-Property/656418/Trademarks-Law-In-India–Everything-You-Must-Know#:~:text=Legal%20Remedies%20against%20Infringement%20and%2For%20Passing%20off&text=A%20trademark%20is%20said%20to,registered%20proprietor%20of%20the%20trademark. (last visited on July 5, 2020). [28] Id. [29] The Design Act, No. 16 of 2000, India Code (1993). [30] Id. [31] The Copyright Act, No. 14 of 1957, India Code (1993), §15. [32] Mondaq, No Copyright Lies With Any Work Registered Under The Designs Act, 2000 https://www.mondaq.com/india/copyright/637576/no-copyright-lies-with-any-work-registrable-under-the-designs-act-2000#:~:text=Section%2015%20in%20the%20Copyright%20Act%2C%201957&text=In%20this%20regard%2C%20as%20soon,any%20copyright%20on%20the%20same. (last visited on July 5, 2020). [33] The Copyright Act, No. 14 of 1957, India Code (1993), §15(2).